Yes, really. Now according to Krugman, in direct contradiction to much of his past writing, the widespread belief that the President of the United States has a significant effect on the U.S. economy, is really a belief that only conservatives hold.

Here is one example opinion piece from Krugman in December of 2014, about what he calls 'Obamanomics', and its supposed positive effects on the U.S. economy --

http://www.nytimes.com/2014/12/29/opinion/paul-krugman-the-obama-recovery.html

The Obama Recovery

Paul Krugman DEC. 28, 2014

...

What’s the important lesson from this late Obama bounce? Mainly, I’d suggest, that everything you’ve heard about President Obama’s economic policies is wrong.

...

This story line never made much sense. The truth is that the private sector has done surprisingly well under Mr. Obama, adding 6.7 million jobs since he took office, compared with just 3.1 million at this point under President George W. Bush. Corporate profits have soared, as have stock prices. What held us back was unprecedented public-sector austerity: At this point in the Bush years, government employment was up by 1.2 million, but under Mr. Obama it’s down by 600,000. Sure enough, now that this de facto austerity is easing, the economy is perking up.

And what this bounce tells you is that the alleged faults of Obamanomics had nothing to do with the pain we were feeling. We weren’t hurting because we were sick; we were hurting because we kept hitting ourselves with that baseball bat, and we’re feeling a lot better now that we’ve stopped.

...

So I’m fairly optimistic about 2015, and probably beyond, as long as we avoid any more self-inflicted damage. Let’s just leave that baseball bat lying on the ground, O.K.?

...

What’s the important lesson from this late Obama bounce? Mainly, I’d suggest, that everything you’ve heard about President Obama’s economic policies is wrong.

...

This story line never made much sense. The truth is that the private sector has done surprisingly well under Mr. Obama, adding 6.7 million jobs since he took office, compared with just 3.1 million at this point under President George W. Bush. Corporate profits have soared, as have stock prices. What held us back was unprecedented public-sector austerity: At this point in the Bush years, government employment was up by 1.2 million, but under Mr. Obama it’s down by 600,000. Sure enough, now that this de facto austerity is easing, the economy is perking up.

And what this bounce tells you is that the alleged faults of Obamanomics had nothing to do with the pain we were feeling. We weren’t hurting because we were sick; we were hurting because we kept hitting ourselves with that baseball bat, and we’re feeling a lot better now that we’ve stopped.

...

So I’m fairly optimistic about 2015, and probably beyond, as long as we avoid any more self-inflicted damage. Let’s just leave that baseball bat lying on the ground, O.K.?

...

As an aside, this is also another example of Krugman's own behavior providing a perfect example of the criticism he is making — in his hypocrisy, he often demonstrates his own accusation. In the opinion piece quoted above, he describes bad economic consequences as self-inflicted damage. That is, like 'hitting yourself in the head, repeatedly, with a baseball bat.' He writes that we should avoid self-inflicted damage, while at the same he is an ardent defender of the absurd notion that there is an upside to the death and destruction of the ultimate 'baseball bat to the head', a World War —

http://maxautonomy.blogspot.com/2014/09/oh-what-ugly-paul-krugman.html

But notice that it is completely nonsensical to name a supposed economic recovery after a sitting U.S. President, as Krugman did in the opinion piece quoted above, if you do not believe that President had an important responsibility in creating that economic event.

As a demonstration of the widespread belief beyond Krugman, that U.S. Presidents have a significant effect on the U.S. economy (whether right or wrong), consider this quote from the Wikipedia page on 'Jobs created during U.S. presidential terms', describing the many references made to a sitting President's supposed ability to 'create jobs' --

https://en.wikipedia.org/wiki/Jobs_created_during_U.S._presidential_terms

Politicians and pundits frequently refer to the ability of the President of the United States to "create jobs" in the U.S. during his or her term in office. [1]

...

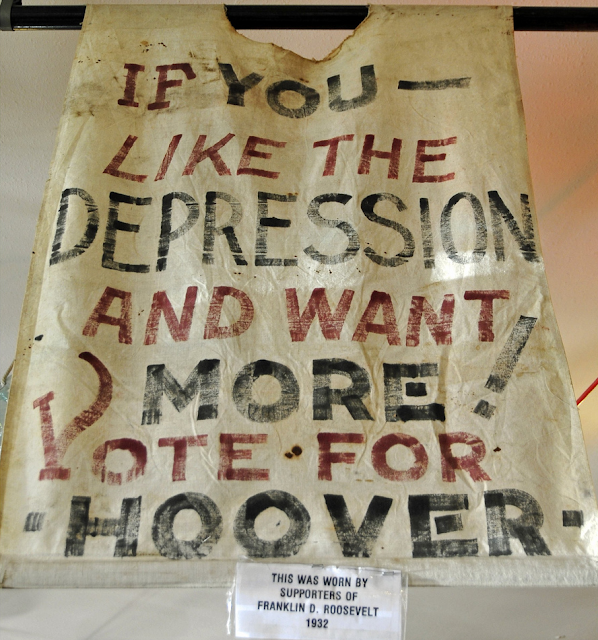

Or consider the expression 'Hooverville', which was the name used for the many shantytowns built during the Great Depression of the 1930's. This name was deliberately chosen to mock the 31st President of the United States, Herbert Hoover, since so many people viewed Hoover as responsible for the Depression. And do not forget that Hoover was a Republican, which means that Democrats (i.e. non-conservatives) believed the President's policies were critical —

|

| Homeless shantytown known as Hooverville, near the Skinner and Eddy Shipyards, Seattle, Washington, June 10, 1937 |

|

| Anti-Hoover Campaign Poster Worn By Roosevelt Supporters in the 1930's |

And for good measure, here is another blog post by Krugman, equating private employment changes with the sitting U.S. President's economic policies — this one-line post is fascinating in its deception (more about that later) --

http://krugman.blogs.nytimes.com/2015/12/27/obama-the-job-killer

Obama The Job-Killer

Paul Krugman DECEMBER 27, 2015 2:43 PM

Given the GOP field’s collective decision to go for Bushonomics squared, it seemed like a good time to update this chart.

Now notice that Krugman wrote the post quoted below, where he insists that only conservatives believe that presidents have a large effect on economic performance, only 3 days after the blog post above where he equated changes in private employment with the two presidents in office during those two time periods.

And even more, notice that Krugman claims that since 2010, the White House has had 'little influence' on the economy, because 'fiscal policy has been paralyzed by GOP obstruction'. So the U.S. President can have a large effect on the economy, but only when a majority of Congress do not disagree and block the President's proposed actions.

Ponder that for a moment — if that damn GOP would stop pretending that the President has an effect on economic performance, and just let him do what he wants, then the President would have an effect on economic performance.

Brilliant Dr. Krugman! --

http://krugman.blogs.nytimes.com/2015/12/30/presidents-and-the-economy/#permid=17088120

Presidents and the Economy

Paul Krugman DECEMBER 30, 2015 9:49 AM

|

| Congressional Budget Office |

After I put up my post comparing private-sector jobs under Obama and Bush, a number of people asked me whether I believe that presidents have a large effect on economic performance. My answer is no — but conservatives believe that they do, which is why this kind of comparison is useful.

To expand on my own views, in normal times the economy’s macroeconomic performance mainly depends on monetary policy, which isn’t under White House control. Now, we’ve been in a liquidity trap for the whole Obama administration so far, giving fiscal policy a much more central role — and the initial stimulus did help quite a lot. Since 2010, however, fiscal policy has been paralyzed by GOP obstruction, so we’re back to a situation where the WH has little influence.

The point, however, is that the right has insisted non-stop that Obama was doing terrible things to the economy — that health reform was a job-killer (one of the dozens of House votes repealing Obamacare was called the Repealing the Job-Killing Health Care Law Act.) The tax hike on the top 1 percent in 2013 was also supposed to destroy the economy (much as the same people predicted disaster from the Clinton hike 20 years earlier.) Financial reform was similarly supposed to be hugely destructive. And there was constant invocation of the “Ma, he’s looking at me funny” doctrine — the claim that Obama, by not praising businessmen sufficiently, was scaring away the confidence fairy.

Given all that, the fact that the private sector has added more than twice as many jobs under that job-killing Obama as it did under pre-crisis Bush is important, not because Obama did it, but because it shows that there is no hint that the important things he did do had any negative effect at all, let alone the terrible effects right-wingers predicted. You can, it turns out, tax the rich, regulate the banks, and expand health insurance coverage without punishment by the invisible hand.

To expand on my own views, in normal times the economy’s macroeconomic performance mainly depends on monetary policy, which isn’t under White House control. Now, we’ve been in a liquidity trap for the whole Obama administration so far, giving fiscal policy a much more central role — and the initial stimulus did help quite a lot. Since 2010, however, fiscal policy has been paralyzed by GOP obstruction, so we’re back to a situation where the WH has little influence.

The point, however, is that the right has insisted non-stop that Obama was doing terrible things to the economy — that health reform was a job-killer (one of the dozens of House votes repealing Obamacare was called the Repealing the Job-Killing Health Care Law Act.) The tax hike on the top 1 percent in 2013 was also supposed to destroy the economy (much as the same people predicted disaster from the Clinton hike 20 years earlier.) Financial reform was similarly supposed to be hugely destructive. And there was constant invocation of the “Ma, he’s looking at me funny” doctrine — the claim that Obama, by not praising businessmen sufficiently, was scaring away the confidence fairy.

Given all that, the fact that the private sector has added more than twice as many jobs under that job-killing Obama as it did under pre-crisis Bush is important, not because Obama did it, but because it shows that there is no hint that the important things he did do had any negative effect at all, let alone the terrible effects right-wingers predicted. You can, it turns out, tax the rich, regulate the banks, and expand health insurance coverage without punishment by the invisible hand.

A number of Krugman's readers commented on the post quoted above, to point out that Krugman's statements in the post are obviously false, but other readers normally responded to those critical comments in disagreement. I was especially amused by the two responses below, where after one reader pointed out the absurdity of Krugman's statements, another responded in perfect Krugman fashion, by attempting to dissemble the obvious contradictions in Krugman's statements.

Notice that 'C' in the second comment below, seems to believe that it is meaningful to compare economic outcomes under different presidents, when you are convinced those presidents do not have a large effect on the economy. So, why would anyone compare any outcomes under two different presidents, for which those presidents were not responsible? --

http://krugman.blogs.nytimes.com/2015/12/30/presidents-and-the-economy/#permid=17088120

Of course, the comment above by 'C' in response to 'Maitland' is absurd on its face. It makes absolutely no sense to discuss economic events under any presidential term, if you really are convinced that sitting presidents are not important to the country's economic performance. This is why you will not find articles, say, regarding the head of the Secret Service and economic performance — that is, everyone really does believe that the Secret Service has nothing to do with economic performance.

And notice this blatantly dishonest language quoted from 'C's' comment above regarding tax reductions for the rich (emphasis added) —

You can be against policies that give money to the rich ...This is a typical propaganda technique — conflating the reduction of a tax payment from individuals (the Bush tax cuts he mentioned), with a gift from others to those individuals. Obviously, this is not what is happening when tax rates are reduced.

And 'C's' closing line is absolutely comical. In a comment denying that U.S. Presidents are important to the U.S. economy, 'C' closes by saying that a larger stimulus would have likely been helpful. As if the sitting U.S. President has no effect on a government stimulus.

And in true Krugman fashion (demonstrating your own accusation), 'C', like many other comment posters on Krugman's blog, begins with an accusation regarding 'not doing your homework', and then proceeds to make a number of nonsensical and false statements, indicating that he needs to do a lot more homework. Now that is a Krugman sycophant.

Here is another small sample of the same kind of nonsense from another Krugman lackey, 'Skeptic' --

http://krugman.blogs.nytimes.com/2015/12/30/presidents-and-the-economy/#permid=17086922

'Skeptic' might try following his own recommendation, by reading about where the expression 'Hooverville' came from, for just one example from history that directly contradicts his view, before he admonishes others to 'try reading history'.

And notice what The New York Times public editor had to say about Krugman back in 2005 — how dishonest do you think Krugman had to be before the paper's own ombudsman decided to call him on it publicly (in this polite way) ? --

http://www.nytimes.com/ref/weekinreview/okrent-bio.html

http://www.nytimes.com/2005/05/22/weekinreview/13-things-i-meant-to-write-about-but-never-did.html

13 Things I Meant to Write About but Never Did

DANIEL OKRENT MAY 22, 2005

...

2. Op-Ed columnist Paul Krugman has the disturbing habit of shaping, slicing and selectively citing numbers in a fashion that pleases his acolytes but leaves him open to substantive assaults. Maureen Dowd was still writing that Alberto R. Gonzales "called the Geneva Conventions 'quaint' " nearly two months after a correction in the news pages noted that Gonzales had specifically applied the term to Geneva provisions about commissary privileges, athletic uniforms and scientific instruments. Before his retirement in January, William Safire vexed me with his chronic assertion of clear links between Al Qaeda and Saddam Hussein, based on evidence only he seemed to possess.

No one deserves the personal vituperation that regularly comes Dowd's way, and some of Krugman's enemies are every bit as ideological (and consequently unfair) as he is. But that doesn't mean that their boss, publisher Arthur O. Sulzberger Jr., shouldn't hold his columnists to higher standards.

I didn't give Krugman, Dowd or Safire the chance to respond before writing the last two paragraphs. I decided to impersonate an opinion columnist.

...

2. Op-Ed columnist Paul Krugman has the disturbing habit of shaping, slicing and selectively citing numbers in a fashion that pleases his acolytes but leaves him open to substantive assaults. Maureen Dowd was still writing that Alberto R. Gonzales "called the Geneva Conventions 'quaint' " nearly two months after a correction in the news pages noted that Gonzales had specifically applied the term to Geneva provisions about commissary privileges, athletic uniforms and scientific instruments. Before his retirement in January, William Safire vexed me with his chronic assertion of clear links between Al Qaeda and Saddam Hussein, based on evidence only he seemed to possess.

No one deserves the personal vituperation that regularly comes Dowd's way, and some of Krugman's enemies are every bit as ideological (and consequently unfair) as he is. But that doesn't mean that their boss, publisher Arthur O. Sulzberger Jr., shouldn't hold his columnists to higher standards.

I didn't give Krugman, Dowd or Safire the chance to respond before writing the last two paragraphs. I decided to impersonate an opinion columnist.

...

The deception regarding the chart that Krugman presented in his blog post 'Obama The Job-Killer', is a perfect demonstration of what Daniel Okrent complained about in the quote above back in 2005.

Krugman's chart comparing job creation under Obama and Bush II seems to put Obama in a positive light, but in truth the chart proves the opposite of the praise that Krugman has given Obama. It is true that during the Obama administration more jobs were added than were added during the Bush II administration, just as Krugman's chart shows — but job creation while Bush II was in office was the worst when compared with all of the presidential terms going back to Lyndon Johnson. So there is no reason for Obama supporters to be praising 'The Obama Recovery', as Krugman has done, since job creation under the Obama administration only slightly edged out one of the worst periods on record, up until the economy collapsed at the end of the housing bubble at the end of the Bush II administration.

That is, job creation under the Obama administration has now, finally, significantly passed that of the Bush II administration, but only because the economy was collapsing at the end of the Bush II administration due to the housing bubble. Faint praise for Obama.

Now, are you surprised that in Krugman's chart showing the change in private employment under Obama, that Krugma also included only the single U.S. Presidential term with the lowest growth in private employment going back to Lyndon Johnson, that is, of Bush II — rather than some other Presidential term that would indicate Krugman's past praise of 'Obamanomics' was false? If you claim surprise at Krugman's obviously misleading comparison, then either you do not regularly read Krugman's writings (good for you!), or you are lying. Krugman proudly and routinely displays his ignorant bias, so it is impossible to enjoy his writing without possessing the same ignorant bias. A critical reader would immediately be suspect of a chart comparing only two U.S. Presidents regarding something as general as changes in private employment, especially when the data for many U.S. Presidents is typically presented together, indicating that it probably took extra effort to compare two U.S. Presidents in isolation, as Krugman did in his previous blog post comparing Obama with Bush II. But certainly no honest reader familiar with Krugman's style, would expect him to create any content that would seriously critique a big government politician like Obama (except perhaps to say that he were not big government enough).

But all of this misses the obvious point that government as a whole has a massive effect on the economy — it is silly to say that a U.S. President is largely responsible for economic performance (as Krugman has often done, his dishonest claim to the contrary notwithstanding), just as it would be silly to say the same of a single U.S. Senator — obviously, the actual laws that are enforced are what matters, and individuals can be crucial to the passage of a certain law, but some kind of consensus is always necessary.

Here is a more honest account of 'The Obama Recovery', and the partial control that U.S. Presidents have over the economy. Of course, Krugman and his sycophants will never acknowledge any of this --

http://blogs.wsj.com/economics/2014/12/05/in-ranking-presidents-by-job-creation-obama-still-lags/

In Ranking Presidents by Job Creation, Obama Still Lags

JOSH ZUMBRUN Dec 5, 2014

President Barack Obama welcomed today’s jobs report, noting that the economy has now created 10.9 million jobs over the past 57 months. This streak of growth is improving the net job creation over which Mr. Obama has presided, though among the last 10 presidents, Mr. Obama still ranks sixth in terms of job creation.

The economy has 5.7 million more jobs today than when Mr. Obama took office in January of 2009. That puts his total job creation ahead of presidents John Kennedy, Gerald Ford, and George H.W. Bush, who each served one term or less. It also puts him well ahead of President George W. Bush, whose final year in office also comprised the beginning to the longest and deepest recession since the Great Depression.

The economy has 5.7 million more jobs today than when Mr. Obama took office in January of 2009. That puts his total job creation ahead of presidents John Kennedy, Gerald Ford, and George H.W. Bush, who each served one term or less. It also puts him well ahead of President George W. Bush, whose final year in office also comprised the beginning to the longest and deepest recession since the Great Depression.

As we have noted before, evaluating the job creation during Mr. Obama’s presidency is skewed by the recession that was already underway when he took office. The same challenge arises in looking at the presidency of Ronald Reagan, who took office just as the economy plunged into a deep recession. President Bill Clinton, by contrast, benefited from taking office as the economy had just begun to snap back from a recession.

...

A range of caveats apply. The president has, at best, only partial control over the course of the economy, especially during his early months in office. The timing of when recessions strike has a key influence on how presidents rank, and economists don’t really believe that presidential policies are the primary cause of sharp economic downturns. Congress can thwart good legislation or pass bad legislation. The Federal Reserve, many members of which were appointed by the previous guy, may make policy errors or set great policy. Demographics and international economic conditions drive much of the economy too.

...

As we have noted before, evaluating the job creation during Mr. Obama’s presidency is skewed by the recession that was already underway when he took office. The same challenge arises in looking at the presidency of Ronald Reagan, who took office just as the economy plunged into a deep recession. President Bill Clinton, by contrast, benefited from taking office as the economy had just begun to snap back from a recession.

...

A range of caveats apply. The president has, at best, only partial control over the course of the economy, especially during his early months in office. The timing of when recessions strike has a key influence on how presidents rank, and economists don’t really believe that presidential policies are the primary cause of sharp economic downturns. Congress can thwart good legislation or pass bad legislation. The Federal Reserve, many members of which were appointed by the previous guy, may make policy errors or set great policy. Demographics and international economic conditions drive much of the economy too.

...

.jpg)